Invest in Real Estate With IRA, 401(k), QRP, HSA, ESA

Self-Directed Tax-Advantaged Retirement Accounts

Account Features & Options

- Includes: SDIRA + IRA-Owned LLC

- LLC Asset Protection

- Traditional/Roth IRA

- LLC Banking Services

- No Transaction Fees

- FinCEN BOI Filing

Total Cost for SDIRA & LLC:

$697 one-time + 399/yr

Is ReSure SDIRA for me?

ReSure SDIRA is for you if you want to use a Self-Directed IRA to invest in alternative assets, but won’t be directly owning a “hard asset.” Express IRA is great for (i) investments in which there’s no hard asset and (ii) investments in which the hard asset is indirectly owned by the IRA-LLC. Express IRA is perfect for investing in real estate syndications, private placements, crowdfunding, crypto and other investments.

If your IRA-LLC will be a direct owner of a hard asset, a Custom Checkbook IRA is the perfectly suited to your needs.

If the funds you’ll be investing are coming from a 401k plan or Traditional IRA – and you have a Solo Business – a Custom Solo(k) may be a good fit.

If the funds you’ll be investing are in a Roth IRA, you must use an IRA to invest, as Roth IRA funds can NOT be rolled over to a Solo(k).

What is an SDIRA? What is an IRA-owned LLC?

A Self-Directed IRA, abbreviated as SDIRA, is an IRA account that can be used for the full array of investments allowed by the IRS. It is an IRA that does not have a the artificial investment restrictions imposed by financial institutions.

However, typical SDIRA investing is cumbersome and costly. This is because every SDIRA investment is manual processed by the SDIRA custodian, incurring substantial costs in terms of time, fees, paperwork.

The solution for this is creation of IRA-owned LLC, which is a specially structured entity owned by an SDIRA and controlled by you, to facilitate easy, streamlined, and low-cost self-directed investing.

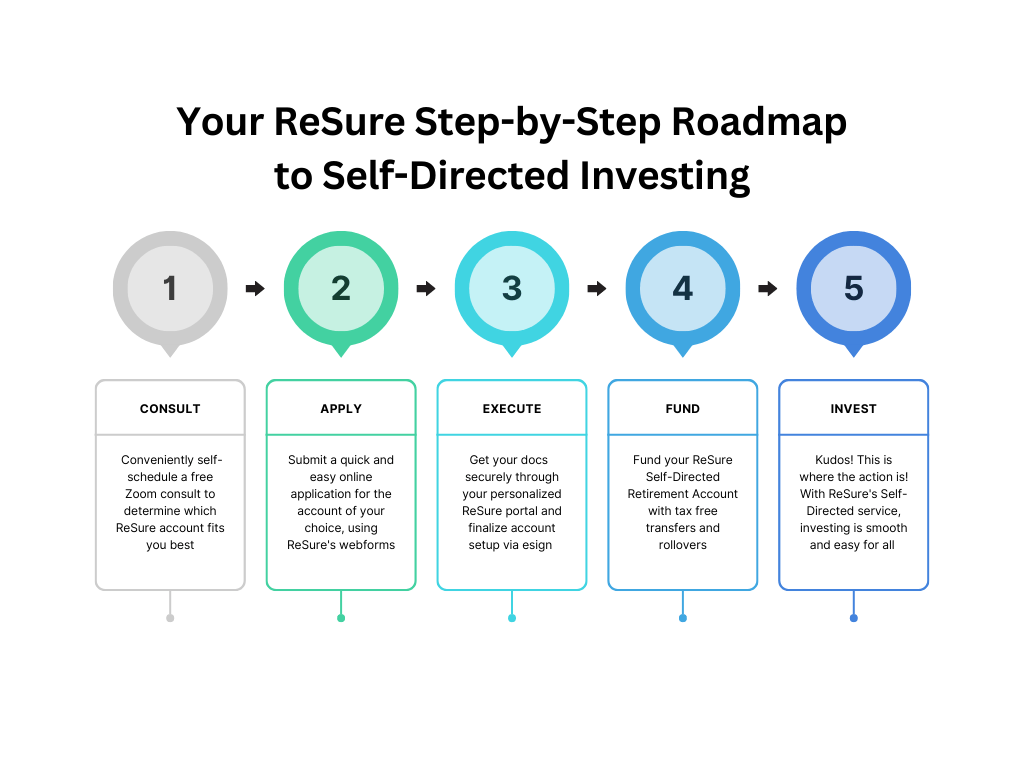

What is the ReSure SDIRA process?

Complete the quick & easy application by clicking on the “Sign Up: Express IRA” button.

Within 2 business days, you’ll receive, via ReSure’s secure portal:

- LLC Articles of Organization

- LLC EIN

- LLC Operating Agreement

- A link to securely complete your account setup with ReSure’s custody & banking partner

Fund the account and start investing in crypto, syndications, private placements and more!

What are the benefits of an IRA-LLC?

Use of an IRA-owned LLC provides the following benefits:

- Substantially reduced SDIRA fees

- Substantial reduction in required investment paperwork

- Easy and streamlined SDIRA investing

- Ability to pursue investments that can not be directly administered by an SDIRA custodian

- Greatest available level of SDIRA control

Transaction Service Features

- Coordination of all transaction stakeholders

- Assistance with all transaction paperwork

- End-to-end white glove support

- Whatever it takes to make it happen

- Get answers to all the big and little questions

- Extensive 1-1 Support for Your Transaction

Total Cost for ReSure Premium

$1997

Do I need ReSure Premium?

ReSure Premium is an optional add-on to ReSure SDIRA account service. You can, and most of our clients do, self-direct your IRA without signing up for ReSure Premium.

Should I get ReSure Premium?

ReSure Premium is recommended if you’re pursuing an investment that entails questions and documentation that are not routine in the SDIRA space.

Isn't this included in typical SDIRA services?

ReSure’s Express SDIRA service provides the most effective and cost-efficient SDIRA account service on the market, bar none. However, typical SDIRA account services include account set-up and account maintenance. Such services include only processing of very specific paperwork and support for general questions, placing the bulk of the transactional work on you.

While this works great for typical self-directed investments, it may not be adequate for more unique investments.

ReSure Premium is designed to address that service gap and bridge the gaps between SDIRA account services and your chosen investment, so that you can proceed with peace of mind and comprehensive support.

What's included in ReSure Premium?

With ReSure Premium services, ReSure will interact with all stakeholders and assist with investment-related paperwork, ensuring that document are properly completed and keeping all parties to the transaction up-to-date and aligned. The more parties to an investment, and the more unique the investment is, the greater the benefit of the service.

What if my chosen investment doesn't work out?

ReSure Premium service is offered as an alternative to hourly transaction consulting services provided by ReSure to SDIRA investors, nationwide. ReSure has provided SDIRA consulting services to investors who have their accounts established with any of the ~50 SDIRA account providers. ReSure Premium provides fixed-fee services that are substantially discounted from ReSure’s hourly rate. Please note that fees for service are earned and non-refundable, regardless of whether you pursue your chosen investment.

What assets can ReSure Self Directed Accounts be invested in?

- Syndications

- Hard Money Loans

- Tax Liens

- Office Buildings

- Apartment Complexes

- Mobile Home Parks

- Residential Real Estate

- Commercial Real Estate

- Senior Living

- Healthcare

- Merchant Cash Advance

- Private Companies

- Precious Metals

- Litigation Finance

- Pre-Settlement Funding

- Structured Settlements

- Bitcoin

- Crypto

- Life Settlements (possibly)

- Viatical Settlements (possibly)

- Retail centers

- Hospitals

- Warehouses

- Parking Garages

- Venture Capital

- Promissory Notes

- Vacation rentals

- Shopping Centers

- Peer-to-Peer Lending

- Private Equity